23. 4. 2024 | Weingarten

CHG-MERIDIAN achieves further successful growth in 2023

• Volume of lease originations in 2023 increased to a record high of €2.45 billion, and profit from ordinary activities to €164.25 million

• Profitable growth driven by successful international expansion of technology2use portfolio

• Increasing regulation concerning sustainability will further boost demand for IT usage models

The CHG-MERIDIAN Group set new records for lease originations and for profit from ordinary activities in 2023. All three business areas – IT, industrial technology, and healthcare technology – as well as all regions contributed to this profitable growth. This underlines the success of the growth strategy pursued by the global technology2use company, whose business model is based on the principle of the circular economy. CHG-MERIDIAN expects a further boost from the rise in regulation around sustainability and ESG, which is set to turn companies’ carbon footprint into an economically relevant indicator. This will drive demand for IT and technology usage models that are sustainable and conserve liquidity.

Despite multiple geopolitical crises, stubborn inflation and rising interest rates around the world, the CHG-MERIDIAN Group reported solid growth in lease originations. They climbed to €2.45 billion in 2023, a year-on-year rise of 9.9 percent (2022: €2.23 billion). Profit from ordinary activities reached €164.25 million, an increase of 20.8 percent on the previous year (2022: €135.92 million). The global technology2use company also achieved robust growth in its managed technology portfolio, registering a new all-time high. In 2023, the company had IT, healthcare technology, and industrial technology assets worth €10.01 billion under management (2022: €8.95 billion). As measured by acquisition cost, the volume was 11.8 percent higher than the previous year. These assets also reach the Group’s technology centers, where used IT hardware is refurbished for a second lifecycle. A total of 895,000 assets were remarketed in 2023, equivalent to a remarketing rate of 95 percent of all returned assets.

Sustainable transformation and global expansion driving success

“Our model of ‘usage over ownership’ addresses the switch from a linear to a circular economy, a trend that is gathering momentum around the world. Leasing and other usage models are generally most popular in times of economic uncertainty. Furthermore, our business model also supports our customers’ transformation,” says Mathias Wagner, CEO of the CHG-MERIDIAN Group.

"After all, investing in hardware is essential to any transformation process. Our innovative, globally scalable technology2use solutions give companies and institutions access to the latest technology without the need to purchase it. This can help to unlock potential for innovation and growth while optimizing liquidity. For us, this means that the age of use has already begun and we must now play an active role in shaping it."

All of the company’s strategic decisions for the future are aimed at increasing the relevance and appeal of the technology2use approach. “With this in mind, we are specifically expanding our international presence in those parts of the world that are key growth areas for our 12,000 customers. We are continually strengthening our presence in line with their requirements, for example in the Asia-Pacific region, where we recently entered into a cooperation agreement in the Japanese market. Around 60 percent of our business is now generated outside Germany,” explains Wagner, adding: “We have also made good progress with our own transformation in 2023 and are investing in the digitalization and automation of our processes in line with our NEXT 2025 medium-term strategy. Alongside our leasing model, we can now offer device-as-a-service solutions and refurbished IT through devicenow and circulee.”

Regulation provides boost for the future of usage models

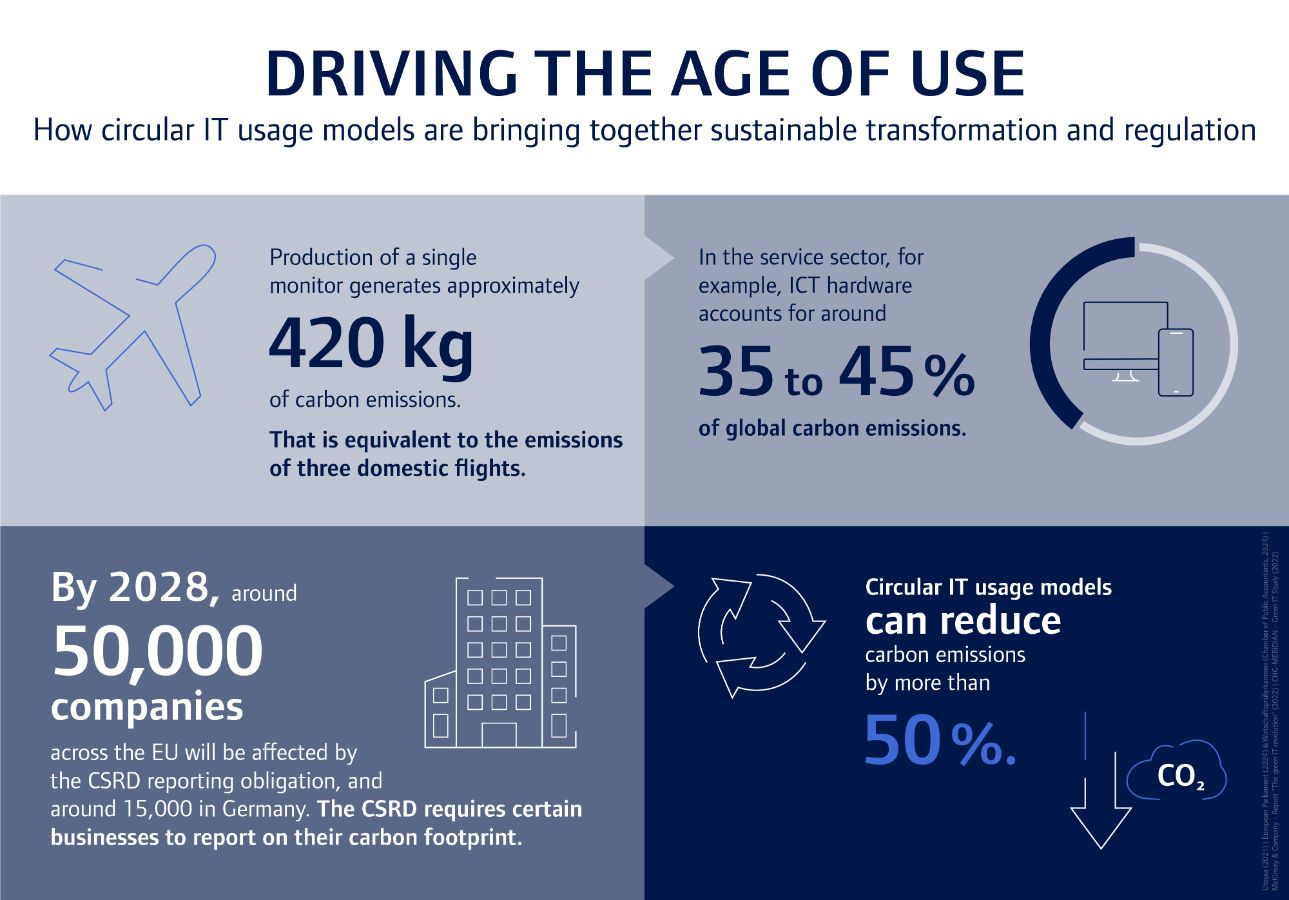

Innovative usage models based on the circular economy allow customers to reduce running costs while maximizing their sustainability performance. The latter is becoming increasingly important for companies as digital technologies often account for a significant share of a company’s total emissions. According to a study by McKinsey, ICT hardware alone is responsible for 35-45 percent of total CO2 emissions in the service sector, for example. “There is enormous potential for savings here, and there is often little awareness of it,” says Wagner. By switching to innovative technology2use solutions based on effective lifecycle management, companies can reduce their IT hardware’s CO2 emissions by more than 50 percent.

The introduction of the European Corporate Sustainability Reporting Directive (CSRD) will only serve to strengthen the position of circular usage models as the aim of the directive is to put sustainability reporting on a par with financial reporting. As a result of this regulation, companies will increasingly find themselves measured against their carbon footprint. “Demand for circular economy expertise is increasing around the world. Regulatory requirements such as the CSRD offer huge potential for progressively adding further services to help companies meet the new requirements placed on them, and thus to highlight our position as a pioneer in the market,” concludes Wagner.